Explore Springs Apartments

This article originally appeared on the Springs "You're Home Blog."

Now that you’ve decided to take out a renters insurance policy for your apartment, one of the most important steps is creating an apartment inventory. Of course, no one expects accidents to happen, but keeping an updated inventory of your belongings can help maximize your reimbursement. If you do end up filing a claim, a comprehensive inventory will show the insurance company exactly what you lost and help them determine the proper compensation. However, the information they use is only as good as the information you provide, so use these 5 tips for creating a thorough apartment inventory:

1. Take Pictures/Video

It’s one thing to write down what you own, but it’s an entirely different story being able to prove its existence. Not only that, but a picture can also easily capture any imperfections in an item’s condition (e.g. cracks, scratches, dents, etc.). As they say, a picture is worth a thousand words, so make sure you visually document all of your important belongings.

2. Get All the Details

Once you have pictures of all your items, make sure you write down every detail you can about them. This includes the item’s name, manufacturer, model/serial number, date purchased, purchase price, and any anything else that would help the insurance company identity the value of the item – even old receipts. The more they know, the more accurate they’ll be with their compensation.

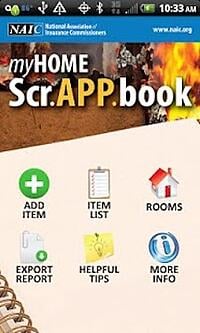

3. Use an App!

One of the hardest parts about making an apartment inventory is simply organizing all of the information. Thankfully, the National Association of Insurance Commissioners (NAIC) created an app that does just that. Using the free MyHOME Scr.APP.book app, policy owners can easily take pictures, add descriptions, and store them electronically for safekeeping. From there, the app organizes the information by room and even creates a back-up file for email sharing. iPhone users can download the app here, and Android users can download the app here.

4. Create Several Back-Ups

As you know by now, having an inventory is crucial to receiving the full compensation from your insurance company. That being said, if your only copy gets destroyed along with your all of your possessions, you’ll really be stuck up a creek without a paddle. To make sure that won’t be the case, make several back-ups of your inventory and keep them in a safe location somewhere other than your apartment. Whether it’s a digital copy on a flash drive or simply more hard copies, you can never be too safe.

5. Keep it Updated

After going through all the work of putting together an inventory, it’s easy for policyholders to call it quits when it’s finally finished. However, you should regularly update it if you want to be compensated for any new items you might have purchased since creating your last documentation. Pick a date every 6-12 months to go through your inventory and make any revisions/additions. Likewise, if you make any expensive new purchases, document them right away, just in case.

Plain and simple, renters insurance can be a lifesaver. And while every policy will vary slightly from insurance company to insurance company, every policy will need an inventory. For additional help with creating your apartment inventory, please contact your local insurance agent.

These Stories on Apartment Living

Take Comfort In Being Home

Visit Our Blog

262-502-5500

We Your Pets

Privacy Policy | Cookie Policy | Terms of Use | Accessibility Statement

Owned and managed by Continental Properties, an award-winning corporate leader and developer of apartment communities nationwide. Copyright © 2025 Springs Apartments